17th June 2019

Facebook to debut their own currency to use on the platforms and employees have the option of taking the cryptocurrency as part of their salaries

[apss_share]

By PC Mag

PC Mag - Facebook's long-rumored cryptocurrency is about to get its big debut. The formal launch is expected sometime in 2020 after a testing phase later this year, but the social network is gearing up to officially announce it with a white paper on Tuesday laying out the basics of its crypto token. Here's everything we know so far.

We've heard rumblings about a secret blockchain project since last May, when Cheddar's Alex Heath reported that Facebook had been exploring blockchain and the creation of its own cryptocurrency for use within its apps since 2017.

Facebook's goal is to launch a virtual token allowing the company's billions of users across Facebook, Messenger, Instagram, and WhatsApp to make digital payments. This includes both internally among other users within Facebook's app ecosystem, and externally on e-commerce purchases and third-party services without ever leaving their Facebook-owned app of choice. The BBC reported it'll be called GlobalCoin, but personally I'm still pulling for Facebucks.

Cheddar reported in December that Facebook was on a hiring spree led by David Marcus, the ex-PayPal president who formerly served as VP of Facebook's Messaging products. Marcus, an early Bitcoin investor who serves on the Coinbase board, confirmed he was leaving Messenger to focus on heading "a small group to explore how to best leverage Blockchain across Facebook, starting from scratch."

The team has grown from a dozen members to more than 50 employees, including the former team behind blockchain startup Chainspace, which Facebook acquired in February.

What We Know About Project Libra

Facebook has explored a number of different avenues while figuring out exactly how the financial side of its cryptocurrency will work. After meeting with dozens of financial institutions and tech companeis about backing its token (including Zuckerberg's old friends the Winklevoss twins), Facebook decided to give up absolute control by setting up an independent governance foundation to oversee the token, according to Heath, now a reporter for The Information.

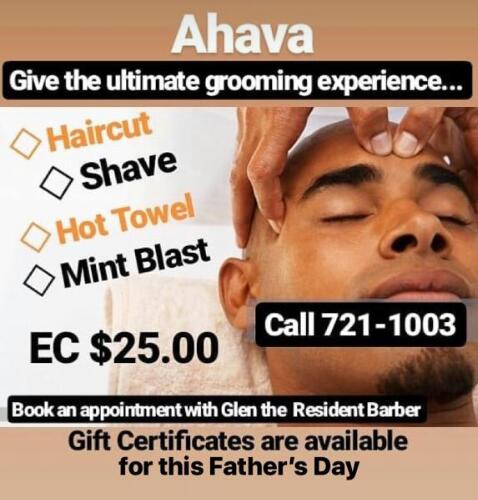

The Information reports that companies can pay $10 million to operate a distributed node on Facebook's blockchain underlying the token, which will be a stablecoin—meaning Facebook's cryptocurrency will have a stable price during payments and transactions, possibly pegged to a number of different global currencies beyond just the US dollar. Facebook employees will reportedly have the option of taking the cryptocurrency as part of their salaries.

(Photo by Justin Sullivan/Getty Images)

Every company operating a node will be part of the decentralized foundation governing the token. As for who Facebook has courted to invest $10 million for a node and join the "Libra Association," The Wall Street Journal reports Marcus recruited his old friends at PayPal along with Visa, MasterCard, and Uber. Also participating in Facebook's crypto payments network are online payments giant Stripe, Argentinian e-commerce marketplace MercadoLibre, and Booking.com.

According to The Block, which obtained a full list of companies involved, the Libra Association's membership also counts venture capital firms including Andreessen Horowitz and Union Square Ventures, other popular apps and websites like eBay, Lyft, and Spotify, telecommunications corporations such as Vodafone, nonprofits, and blockchain companies including leading crypto exchange Coinbase. In addition to buying nodes, the companies will all reportedly co-sign the white paper.

One sector that didn't jump at the opportunity is Wall Street; firms including Goldman Sachs and JPMorgan reportedly passed. At least three companies chose not to partner with Facebook due to data usage concerns, CoinDesk also reported.

How Will This Work?

There's a lot we don't know. The tokens will reportedly be transferrable with no fees between Messenger, Instagram, WhatsApp, and other Facebook-owned apps and services. So for users who need to send money to friends within the Facebook ecosystem, the coin could serve as a way for Facebook to undercut services like Venmo and Apple Pay Cash. Acquiring Chainspace helps Facebook on the transactional side; the startup was working on decentralized smart contracts to facilitate faster blockchain-based payments.

The cryptocurrency is also key to Facebook's grand e-commerce designs. Facebook is building out a network of businesses and merchants to accept GlobalCoin (or whatever it's ultimately called) as payment, and Facebook plans to make its cryptocurrency available to exchange from traditional currency through physical ATM machines, The Information also reported.

The most ambitious aspect of the stablecoin may be its potential to tie the global financial system together through a single crypto asset. Laura McCracken, Facebook's head of financial services and payment partnerships for Northern Europe, told a German business magazine that GlobalCoin won't be tied to any single fiat currency, but will be linked to multiple currencies to prevent volatility.

As for the financial and technical specifics of how that would work, and how decentralized (or not) the network ultimately is, we'll have to wait for the white paper.

What 'Facebucks' Mean for the Crypto Market

Whatever it's called—Facebucks, Facecoin, Zuck Bucks— Facebook's token is poised to achieve two very important firsts for cryptocurrency: the first crypto asset launched by a major tech company with a wide global rollout across both the financial world and consumer web services, and the launch of the most high-profile stablecoin ever created.

Stablecoins are enticing but risky endeavors, and in some cases fraught with controversy. The idea behind a stablecoin is to reduce the volatility and uncertainty of crypto prices to ensure that conversions, remittances, and other transactions remain, well, stable for consumers.

There are a few ways to do this. One is to peg a cryptocurrency either as a fiat currency (or in Facebook's case, a basket of currencies) such as in the case of Tether, the most high-profile stablecoin until now, which is in theory pegged 1:1 to the US dollar. This turned out not to be entirely true, and Tether has dealt with a myriad of issues, from allegations of price manipulation to a loss of trust and investigations into in whether the coin was fully backed and was used to cover popular exchange Bitfinex's losses.

Stablecoins can also be peggged to a reserve resource like gold or silver, or in some cases it can be a coin where the supply, demand, and exchange rates are monitored and controlled to keep prices consistent. Stablecoins have gained popularity in countries like Venezuela where citizens need an alternative to the hyperinflated bolivar, but they can come in many different forms. JPMorgan's JPM Coin is a stablecoin in a fashion (albeit only for use within the bank's own private blockchain network), and IBM has partnered with blockchain payment network Stellar to let international banks launch their own stablecoins on the Stellar public blockchain.

A Lightning Rod for Regulation

The moral is, Facebook's coin will work quite differently from Bitcoin, Ethereum, or any of the mainstream cryptocurrencies built on public blockchains. Facebucks won't be transacted over a public blockchain like Bitcoin where it would be difficult for Facebook to ensure the coin wasn't being used for illegal activities; the private, permissioned network set up through the Libra Association (where only verified companies control nodes) creates a network that's still decentralized to a degree, but governed and monitored by a foundation that Facebook and its partners control.

Bloomberg reports that Facebook will test its stablecoin first in India for WhatsApp transfers, with the goal of realizing one of cryptocurrency's ultimate goals: seamless cross-border payments and remittances anywhere in the world.

Facebucks will shine a bright light on the cryptocurrency market as a whole, and it'll also come with increased regulatory scrutiny from US agencies, including the SEC and CTFC, as well as countries worldwide. Rolling out a global stablecoin of this kind that's pegged to multiple currencies and backed by giants of the tech and financial worlds will force the kind of accelerated regulatory action that the cryptocurrency market has been waiting for.

It'll also mean a lot more financial lobbying for Facebook, which is already dealing with multiple inquiries and regular calls for the social giant to be broken up. In May, members of the Senate Banking Committee sent an open letter to Zuckerberg inquiring into how Facebook's cryptocurrency and payments system will work. Facebucks may ultimately be a net positive for cryptocurrency's legitimacy in financial markets and its fully realized potential for cross-border payments, but its most immediate impact may be the fallout of whatever regulations are enacted to police it.

The Ripple Effects of Facebook's Big Pivot

Mark Zuckerberg's messaging has changed significantly in the wake of Facebook's tumultous stretch of privacy scandals, security breaches, and regulatory actions since the 2016 election.

After 15 years of making billions from online advertising as its core revenue stream, Zuck wants to change the core bargain at the heart of Facebook (and free online services writ large). Since the dawn of social networks, the trade-off has always been: we give you a free service, and you give us your personal data to target advertising at you. Most users didn't realize the implications and ramifications of this bargain until the Cambrdige Analytica scandal and subsequent privacy revelations woke us up, but that transaction is at the heart of how the modern internet works.

In March, Zuckerberg outlined plans to re-engineer Facebook and its entire app family from the ground up as a "privacy-focused platform." In April, at Facebook's F8 developer conference, Zuck expanded on that foundational pivot by announcing that the company is overhauling the infrastructure behind Facebook, Messenger, Instagram, and WhatsApp to make end-to-end encryption the default standard and promote private conversations where Facebook collects less personal data.

On the one hand, this broader unification fits with Zuckerberg's vision to enmesh all of Facebook's apps and make them more interoperable. The founders of Instagram and WhatsApp have all left the company one after another, reportedly amid increasing pressure from Facebook to integrate their apps more deeply with the mothership. On the other is this shift toward unified privacy.

Facebook's revenue will always be built on targeted advertising, but it's telling that at the same time Zuckerberg announced the new, privacy-focused Facebook, he also touted a slew of new features around e-commerce and shopping. At F8, Facebook announced that it's redesigning the Marketplace with shipping support for sellers, that Instagram users will be able to buy products directly from influencers, and that businesses will be able to upload product catalogs to WhatsApp. Facebook already lets Messenger users interact and shop directly with brands.

Wouldn't it be easier for users if they could complete all these transactions with Facebook's built-in money?

The true value of a crypto coin for Facebook is in convenience and engagement. Beyond any kind of altruistic notion of advancing an economic vision of digital money, Facebook is connecting all its apps and giving users a universal currency to use within them. Billion of users who already use these apps daily or monthly will have a built-in mechanism to spend their money there, too. The implications of this shift could turn Facebook from an online ad behemoth into a financial services and shopping giant to rival Amazon and big banks.

If Zuckerberg does see his vision of a private Facebook become a reality, the new connected continuum of Facebook apps will have a self-sustaining e-commerce and shopping ecosystem built in to keep its billions of users sated within the walled garden.

[apss_share]